- Letter from the Board of Directors

- Management report

- Key figures

- Foundations for success

- Business model

- Strategy 2030

- Risk management

- Stakeholders

- Organisation

- Sustainability

- ESG governance

- Material topics and SDGs

- Economic impact

- Environmental impact

- Social impact

- Governance

- Corporate Governance

- Board of Directors

- Management Board

- Additional information

- Remuneration

- Remuneration report

- Notes to the report

- CO reference table

- Statement by the Board of Directors

- GRI content index

- Due diligence and transparency

- Financial report 2023

- Vetropack Group

- Consolidated balance sheet

- Consolidated income statement

- Consolidated cash flow statement

- Changes in consolidated shareholders’ equity

- Consolidation principles

- Valuation principles

- Notes

- Ownership structure

- Company participations

- Five-year overview

- Vetropack Holding Ltd

- Medium-term return target, 2030: ROOCE (Return On Operating Capital Employed) of 20 percent

- Investment focus: increase production capacity, economic and environmental efficiency

- Multi-year programmes to upgrade peripheral production processes and those in administration

“

In the interests of Vetropack’s majority shareholders, our financial management aims to achieve our company’s self-financed development in the long term.

David Zak, CFO

SustainabilityEconomic performance

Our overriding goal is sustainable growth. We set ourselves targets for sustainable return on operating capital that promotes long-term growth. In doing so, we take account of the interests of our stakeholder groups, and of the social, economic and environmental impacts of our business activities.

Vetropack’s strategy is geared to the company’s long-term development, taking account of the concerns of our stakeholder groups. Growth generates the resources needed for investments that will secure our successful market position. The profitability of our investments ensures that we have the relevant capital at our disposal.

Since Vetropack’s growth is largely self-financed, we attach great importance to the cash flow margin and profitability. One key indicator for these parameters is Return on Operating Capital Employed (ROOCE), which must be around 20 percent in the medium term. Long-term financing of the company’s ongoing development is ensured by optimised employment of capital and a positive cash flow after deducting investments and dividend payments.

Investments in sustainability

It is our general practice to include ecological aspects in our investment decisions. For example: we assess potential savings of energy and CO2 on the basis of anticipated future prices for energy or CO2 certificates.

Focal points of our investments include new furnaces (e.g. oxy-fuel or hybrid furnaces) and cullet processing plants. In both these cases, we are improving our economic and ecological efficiency. The energy performance of a new furnace, for instance, is usually about 10 percent better than the rate for its predecessor. This is because furnaces lose about 1percent of their efficiency each year due to decreasing insulation performance. By using our own cullet processing plants, we not only improve our supply of raw materials but also reduce our energy costs.

Clearly Sustainable is one of the cornerstones of our strategy – and to continue strengthening it, we intend to invest more in progressive ecological technology. But suitable options are often unavailable, so we motivate our suppliers to develop appropriate solutions.

Progress and events in the reporting year

Resumption of production in GostomelIn May 2023, we were able to resume operations at our Gostomel plant in Ukraine, which was severely damaged at the beginning of 2022 due to the war. The site was able to finance the repair work from its own resources, because the stocks destroyed by the attack could be sold as cullet to other Ukrainian glass manufacturers at a good price.

Opening of the new Boffalora plantVetropack has invested about CHF 400 million in the new production facility at Boffalora, Italy. Around 70 percent more glass can be produced here than in the previous plant. This makes it much simpler to serve our customers in Italy with improved resource efficiency and more favourable costs. Sites that have previously supplied Italy now have additional capacities for their local markets.

Investments in state-of-the-art technologyVetropack invested in cutting-edge technologies during 2023. For example: the first servo-driven electric glass-blowing machine was installed at our plant in Kyjov. On the one hand, the NIS machine is the most flexible high-performance machine on the market – and on the other, it substantially reduces energy consumption because the servo motors use the electricity directly, without an intermediate compressor.

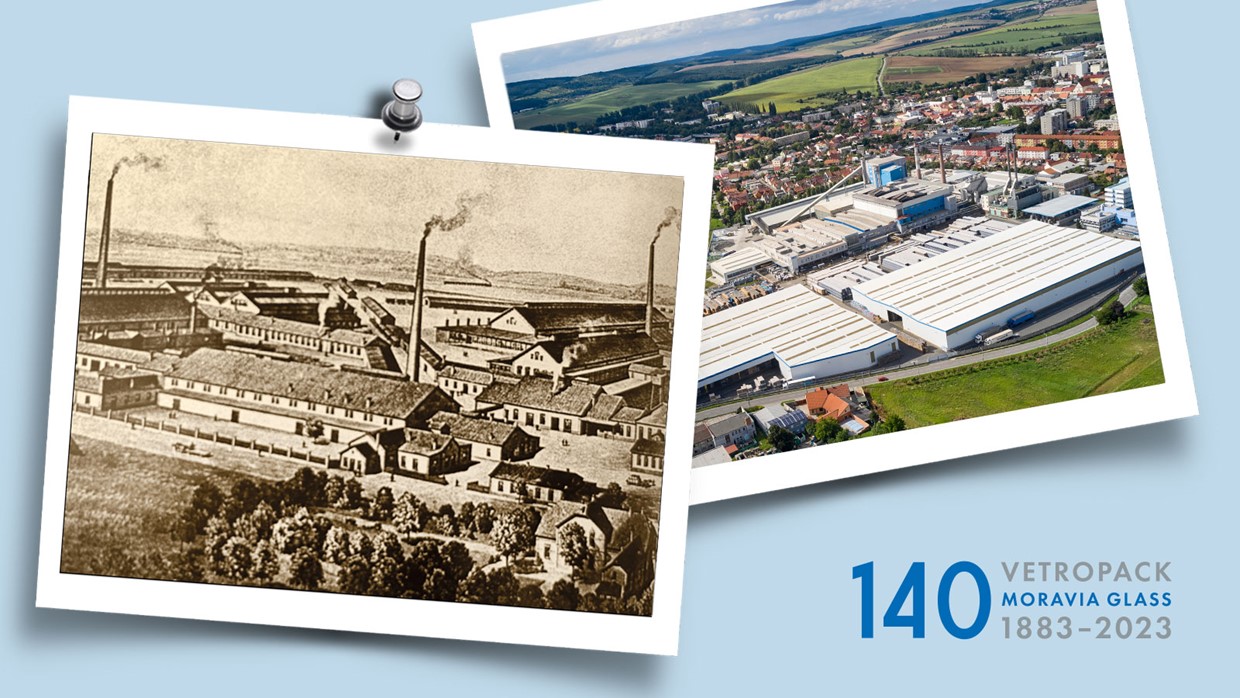

Vetropack Moravia Glass celebrates its 140th anniversaryThanks to our innovation strategy, we were able to commission a new coloured glass furnace and a new NIS machine at our Kyjov plant in the Czech Republic. The new furnace was specifically developed to produce coloured glass, with higher capacity per day than its predecessor, resulting in significantly increased efficiency.

Croatia’s accession to the Schengen area makes processes easier

Croatia’s accession to the Schengen area makes processes easierCroatia acceded to the Schengen area and joined the European Economic and Monetary Union (EMU) in January 2023. Since then, it has been possible to cross the country's borders freely without personal identity checks. Free border crossings now facilitate processes at Vetropack Straža, and currency risks relating to our Croatian site are also reduced. At the plant itself, EMU accession required extensive preparations such as converting the Enterprise Resource Planning (ERP) software and business processes to the new currency.

Optimised peripheral production processesVetropack has responded to increasing competition, customers’ requirements and the impact of inflation on economic performance by introducing its Performance Improvement Programme or PIP. The PIP pursues a structured approach in order to cut costs, boost overall performance, and implement best practices in production. The focus here is on peripheral processes.

Boosting efficiency in administrationIt is our goal to have efficient processes in place throughout the Vetropack Group. To achieve this, our optimisation programmes also include our administration. In the year under review, three areas – HR, Procurement and Finances – have analysed their processes and developed implementation plans with estimated implementation costs and cost savings. The same procedure will be applied to processes in IT and Sales in 2024.

Performance indicators

GRI 201-1 Direct economic value generated and distributed

Key financial indicators can be found here.

- Vetropack Group

- Corporate Governance

- Governance

- Social impact

- Environmental impact